The story behind Crafted Wealth

Crafted Wealth evolved out of the burning desire to become masters of our craft. As craftsmen, we’re committed to the highest of standards. We act as fiduciaries for our clients and have a compensation model that bucks current industry trends. This best aligns us with our client's goals.

Our beliefs around money revolve around three ideals:

Making it.

Keeping it.

Growing it.

These three pillars amount to:

A healthy and growing career.

A well thought out budget.

A plan to accomplish your goals.

We’re here to help coach you through the process and be your guide.

Gabe the Craftsman...

I’m proud to be a CERTIFIED FINANCIAL PLANNER ™.

I founded Crafted Wealth in 2015 with the vision of redefining personal financial planning. There are no cookie cutter plans here. After all, the plan is yours and you need to believe in it to see it through.

My financial planning career began in 2010 at a leading national firm in Milwaukee, WI. This initial experience gave me a taste of the industry, both the good and bad. Often, when people hear financial advisor they instantly think investments... That's a failure of focus in my industry. What I’m really here to do is coach and empower you so that you feel empowered by your finances. I can teach you how to manage your life, get excited about what you have right in front of you, and help you realize what you’re truly capable of. It's powerful stuff!

In 2012 I moved to Los Angeles, CA for an opportunity to work with an experienced wealth management firm. It's here that I dove deeper into planning and investments. I knew early on that continuous education was important to my ability to do what’s right for my clients. Right after moving to Los Angeles, I studied for and gained my Certified Financial Planner (CFP), Chartered Life Underwriter (CLU), and Chartered Financial Consultant (ChFC) designations.

I grew up in Cedarburg, WI with my sister Bethany and parents Brant and Carol. Growing up in the Midwest gave me a strong work ethic and instilled in me an entrepreneurial spirit.

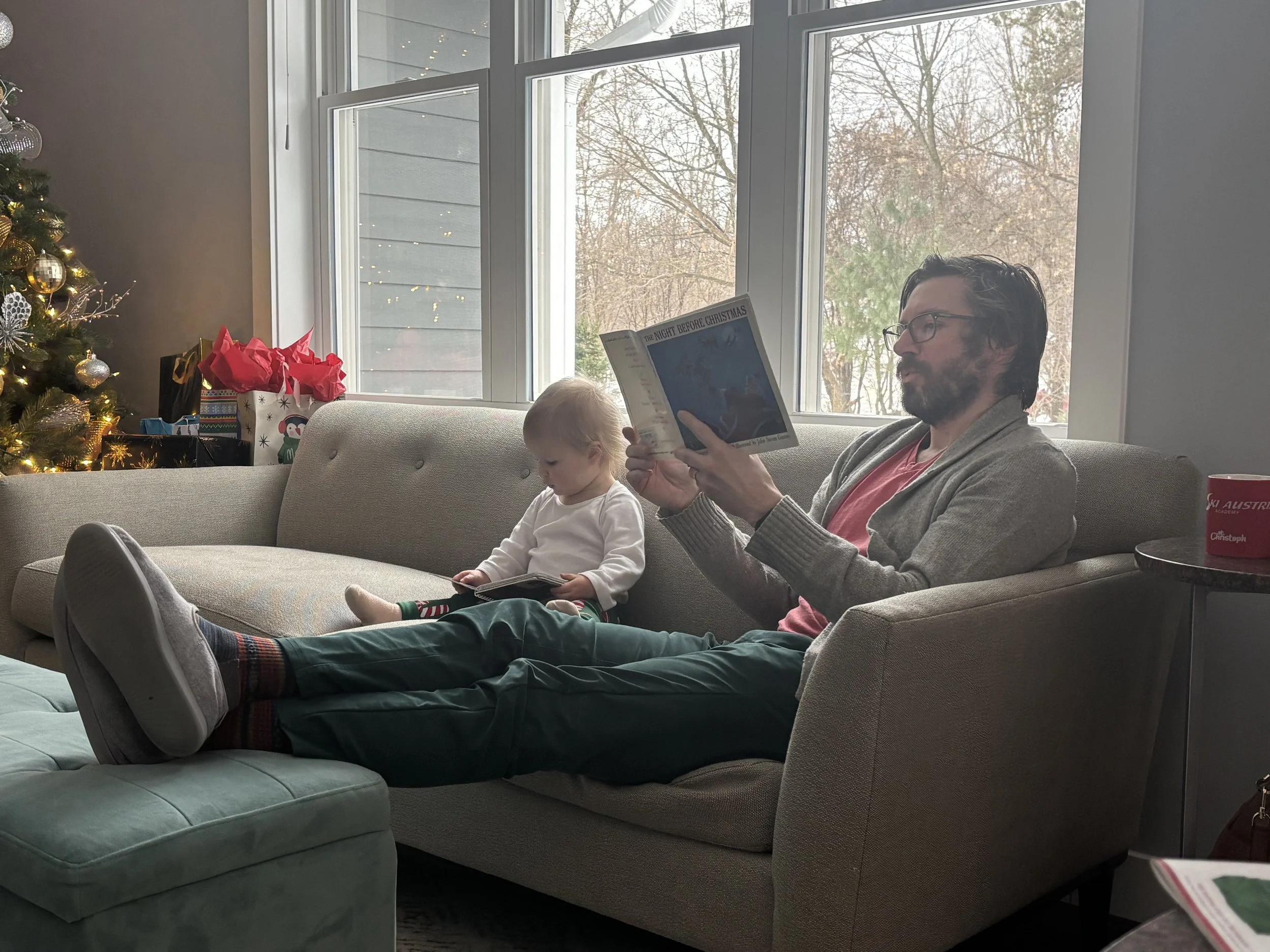

After a decade living in Venice, CA, my wife Megan and I moved to Minneapolis, MN in 2022 and started a family of our own. Landing back in the midwest by choice has been awesome! It’s near to our families and has allowed us to reengage in hobbies: car culture, mountain biking, hiking, backpacking, skiing, and snowboarding. We also live close to MSP which can take us anywhere in the world (often back to Los Angeles to visit friends and clients).

I am EXCITED to help you through your journey and make decisions that truly align with YOU. I look forward to getting to know you and helping you think about, plan, build, and support your ideal life.

Let’s take the next step and see if we’re a good fit. Schedule a meeting for us to get to know each other here.

Tatiana the Planning Resident...

I believe financial security is about more than just the numbers — it’s about freedom, choice, and building a life that aligns with your values. I bring a wide range of experience to my work in financial planning, grounded in a deep respect for the role money plays in our lives — but never letting it define us.

I joined Gabe and Crafted Wealth Management in 2024 after spending over a decade in the entertainment industry, working in leadership and strategic content roles at companies like Hulu, Discovery, and Warner Brothers. As a content buyer, I managed multimillion-dollar budgets, negotiated complex agreements, and helped steer big-picture strategy — experience that sharpened my analytical thinking and made me comfortable handling complexity and long-term planning. That same skill set now supports my work with clients as we build clear, realistic plans.

I met Gabe in 2017 when I was looking for financial advice on the basics; what to do with my 401k and what a normal budget should look like. I’ve been a client since then and he’s supported me through major life changes including getting married and joining finances with my husband, buying our first home, a myriad of real estate investing and, eventually, figuring out how to balance childcare costs. As we had lengthy talks on the subject of financial independence, he helped me realize I was ready to transition away from my career in corporate to something more meaningful to me presently. This led to me convincing him to hire me, and here we are!

My path to financial planning is deeply personal. I immigrated to the U.S. from Argentina during an economic crisis, and watched my parents navigate financial instability in a country where they didn’t speak the language. From a young age, I understood that financial independence is critical — not just for stability, but for peace of mind.

At Crafted Wealth, I help with every part of the planning process — from preparing for meetings and building financial plans to refining budgets and supporting implementation. I’ve completed the CFP® coursework and am currently fulfilling the experience requirement before sitting for the exam. My goal is to help clients feel confident that they’re making smart, informed decisions — and to remind them that they don’t have to do this alone.

After living in LA for over a decade, I now live in Miami with my husband, Damien, and our daughter, Mila. When I’m not working, you’ll find me gardening, listening to audiobooks, baking something with my family, or relaxing at the beach. I’m also a real estate investor and enjoy sharing what I’ve learned with clients exploring that path.

Why are we here?

We’re here to give you a planning experience that is more than just financial.

Let’s take a moment to sit down and reflect on your past year. What are things that stand out? Was it your trip to visit family? A best friend’s wedding? Did you make the decision to buy a new house? Did your kids just graduate school? Have you finally set the ever exciting date of retirement?

The decisions you made in the past led to those happy moments over the last year. What do you need to do to make sure they keep happening?

When we at Crafted Wealth look at life, we want to make sure we are a positive influence in our industry. We also want to maximize happiness, spend life with the people we love, and allow for flexibility. It’s easier for us to make daily decisions because we know what our values are.

Have you thought about what your values are lately? Have you thought about whether your daily decisions align with what’s important to you?

We are here to take you through the hand-crafted planning process. This process will help you rediscover and visualize the values you may have put aside during your everyday life. But maybe you are thinking:

Should I contribute to my 401k? What investments best align with my ideals and goals? Should I worry about recent investment performance? Will our pension support us in retirement? What accounts should I take money out of first in retirement to cut taxes?

With your values as context, the answers to those questions begin to have substance. This is the hand-crafted way!